According to the ICAO and IATA data, the exit of the tunnel in the air sector does not seem to begin to be seen until the beginning of 2021. At this point, most operators assume this new normal with four main unknowns: what aircraft operating and occupancy restrictions will exist and until when; the temporal extension of the pandemic, its outbreaks and the arrival of a cure; the economic capacity of passengers to fly again and the population’s fear of getting infected by traveling by plane or to certain destinations.

The sector has assumed that the return will be staggered, adapting to demand and containing costs to the maximum. For this reason, commitments to purchase new aircraft are already being canceled or their deliveries delayed.

In fact, Airbus and Boeing expect a decrease in demand in the coming years of up to 70%. Thus, Airbus announced on April 8 a cut in its production by a third, and Boeing recently closed the production of its B787 in one of its plants.

Despite this, this crisis will probably increase the need for much more efficient aircraft, especially if it is taken into account that for a certain time the number of passengers per flight may be forced to limit.

It is also believed that the pandemic may increase passenger interest in direct city-to-city flights, minimizing exposing their health.

All this will drive the updating of fleets with more efficient and sustainable aircraft. In fact, Lufthansa has already announced the recall of some of its more obsolete A380, A340, and B747.

Faced with such a situation, Airbus has an advantage thanks to its A320Neo and A220, and thanks to the problems of the Boeing 737MAX whose crisis is either resolved soon or they will have to look for a replacement if they do not want to sharpen their battered position. Demand for wide-body aircraft is also expected to decline for this decade.

The slow return to operations, the general decrease in the volume of aircraft, and the increasingly modern aircraft can put maintenance companies, especially the smaller ones, in check.

In fact, there is a concern in the sector about how these firms, together with small manufacturers of components and spare parts, will be able to survive in the face of an eventual decrease in business after a period of lack of liquidity, and its effect on the supply chain.

However, a slow recovery can have its advantages. The first is that it is better suited to the times that crews, aircraft, and suppliers will need to reactivate the business.

Despite the fact that many crews are conducting training and the license update periods are being extended, it will be necessary to carry out simulator sessions, verifications, and updates to new regulations derived from the pandemic.

In addition, airplanes that are currently in hibernation mode require a certain time to become operational again.

Another advantage is that this crisis gives the sector the opportunity to increase its flexibility, its ability to quickly adjust to changing needs and avoid monolithic structures.

In fact, the search for greater efficiency and responsiveness is believed to drive the use of Artificial Intelligence and the Internet of Things (IoT) in all areas of the sector, in addition to creating a greater window of opportunity for many of startups that have developed very interesting proposals in the aerospace sector in recent years.

At an operational level, the crisis will boost the LCC management strategies for all operators in terms of flexibility, efficiency, and cost control.

Facing the tunnel exit, most likely the routes with the highest volume of flights will be limited to domestic and/or regional routes, increasing long-haul routes as the different foci of the disease are resolved and the possibility of outbreaks stabilizes.

Now, few people in the sector dare to predict whether the recovery in demand will come from the hand of business or pleasure trips.

There are questions about whether the massive use of teleconferencing and teleworking will translate into a lower volume of business trips, a more profitable customer profile for airlines, or even a 20% increase in the business jet segment due to the pandemic will continue overtime to preserve the safety of key people in the companies.

The desire to return to normality and fly for pleasure, not only health risks can be countered but also the possible extra costs in tickets derived from the new way of operating of the airlines.

For example, the Emirates company recently communicated how the operation of its long-haul flights would be, very similar to that already applied by Chinese operators for their international flights.

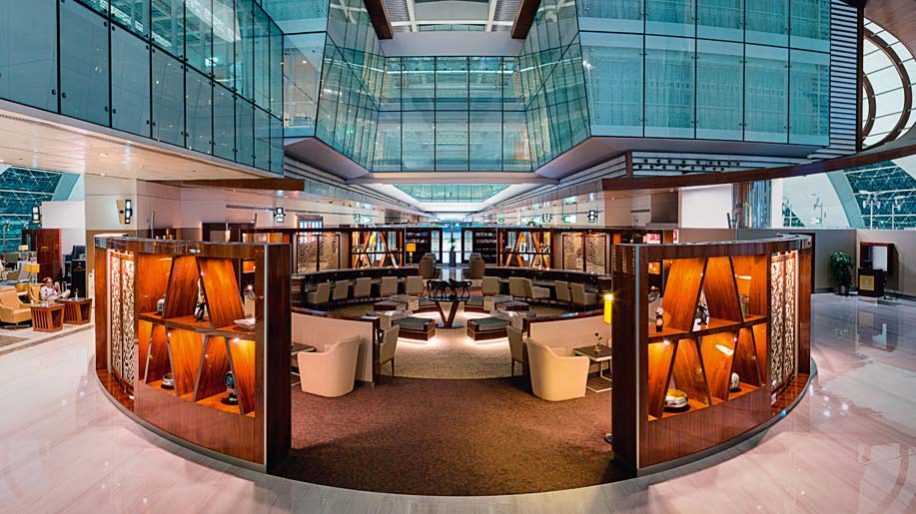

They are also offering one of the best Dubai business class lounge services at all terminals.

They will be carried out in shifts on the same day for crews with longer hours, fewer cabin crew members will be assigned than usual, while there will be two crews, the first-class cabin will be blocked for exclusive crew services, there will be one crew member on each flight who will be responsible for constantly cleaning the toilets on board, upon return will test each crew member for COVID-19 and they will only be able to fly again after the test is confirmed negative.

All this entails a higher cost, especially if one takes into account the need to have several crews or planes available in case the tests come back positive or an aircraft becomes contaminated.

It is difficult not to think that short-haul passengers, even low-cost passengers, do not expect similar measures to guarantee their safety.

The costs can be seen to increase ostensibly and the impact can be very relevant because perhaps these planes will initially fly below their profitability equilibrium occupation if the middle seat is still kept free as a measure of social distancing.

By shifting these costs into ticket prices, demand for travel across the board is likely to contract, making many LCC and Legacy carrier routes unviable.

The segment that responds with the most speed and volume to the supply will define the sector in the next three or five years.

We will then see if we are going towards more sustainable growth and with large operators that consolidate their position or if there is more dynamism than expected with a flexible market that generates opportunities for many operators.